High currency exchange fees and transaction charges have long been a source of angst while travelling, and once I’d decided to embark on long-term travel I opened an account with Revolut to use for my day-to-day spending abroad.

Revolut is one of the new generation of Internet banks, offering online-only services based on apps. It boasts a growing range of functionalities and perks, with three types of membership that include more stuff as you go up the scale.

Standard

A basic free account with several features:

- Free Euro IBAN account

- Spend in more than 150 currencies at the interbank exchange rate

- Exchange and transfer up to £5,000 per month in 30 currencies without any hidden fees

- Free and fast money transfers in 30 currencies

- Free cash withdrawals up to £200 per month

- Stock trading account with 3 free trades per month

- Vaults to put aside money with one-off or recurring transfers and/or round up spare change from every card transaction

- Analytics tab and monthly budgeting tool to track spending

- Instant spending notifications

- Shopping discounts with Perks Plus

- Free debit card (excl. £4.99 delivery)

- Open Banking to connect your external bank accounts and see everything in one place

Premium

A premium account with a £6.99 monthly fee gets you extra features:

- Free Euro IBAN account

- Spend in more than 150 currencies at the interbank exchange rate

- Exchange and transfer 30 currencies with no monthly limit

- Free and fast money transfers in 30 currencies

- Free cash withdrawals up to £400 per month

- Travel insurance

- Stock trading account with 8 free trades per month

- Buy gold with supported currencies and cryptocurrencies

- Instant access to 5 cryptocurrencies

- Vaults to put aside money with one-off or recurring transfers and/or round up spare change from every card transaction

- Analytics tab and monthly budgeting tool to track spending

- Instant spending notifications

- Buy cryptocurrencies with spare change

- Savings Vaults pay annual 1.35% interest equivalent daily

- Debit card with exclusive designs

- Global express delivery

- Priority customer support

- Disposable virtual cards

- LoungeKey airport pass access

- Free lounge passes for you and a friend if your flight is delayed by more than 1 hour

- Shopping discounts with Perks Plus

- 2 Junior accounts for kids

- Open Banking to connect your external bank accounts and see everything in one place

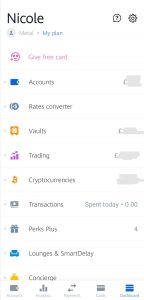

Metal

- Free Euro IBAN account

- Spend in more than 150 currencies at the interbank exchange rate

- Exchange and transfer 30 currencies with no monthly limit

- Free and fast money transfers in 30 currencies

- Free cash withdrawals up to £600 per month

- Travel insurance

- Stock trading account with unlimited free trades per month

- Buy gold with supported currencies and cryptocurrencies

- Instant access to 5 cryptocurrencies

- Vaults to put aside money with one-off or recurring transfers and/or round up spare change from every card transaction

- Analytics tab and monthly budgeting tool to track spending

- Instant spending notifications

- Buy cryptocurrencies with spare change

- Savings Vaults pay annual 1.35% interest equivalent daily

- Stainless steel debit card

- Global express delivery

- Priority customer support

- Disposable virtual cards

- LoungeKey airport pass access

- Free lounge passes for you and up to 3 friends if your flight is delayed more than 1 hour

- Shopping discounts with Perks Plus

- Cashback vault receiving 0.1% within Europe and 1% outside Europe on all card payments, with a choice of 30 currencies and 5 cryptocurrencies

- Access to a concierge to help you manage your lifestyle

- 5 Junior accounts for kids

- Open Banking to connect your external bank accounts and see everything in one place

Revolut has just launched in the US for those Stateside who want to check it out.

Banking

Because I’m abroad for extended periods of time, I opted for a Metal account to get the most cash withdrawals and cashback — the account more than pays for itself with the amount of money saved compared with the foreign transaction fees and commissions my High Street bank charges. And when Revolut added the Savings Vaults in February I immediately transferred money from my bank savings account, where the interest rate is practically zero. It’s very satisfying to see the interest hit the account daily, as well as receiving cashback for card purchases.

The Revolut app features a clean, intuitive layout where you can access the various account features. There are 5 tabs along the bottom of the screen: Accounts, Analytics, Payments, Cards, and Dashboard.

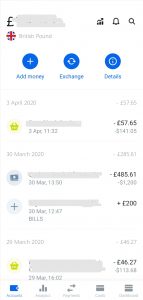

The Accounts tab shows your balance and recent transactions. You can set up multiple currency accounts and switch between them from a simple dropdown list.

Each transaction is tagged with a category and has its own page where you can see further details including the exchange rate, statistics on your spending with that merchant, add notes and attach a photo or file of the receipt.

Each transaction is automatically given a category, which you can reassign as needed and is then the basis for the Analytics tab.

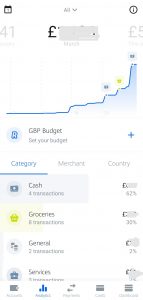

The Analytics tab shows your total monthly spending and breaks it down by Category, Merchant and Country. You can add a budget for the month and different categories in this tab. There are 14 categories and you can add your own custom entries.

The Payments tab allows you to transfer money, split a bill with another Revolut user or send a payment link to request money. There is a People Near Me option to briefly turn on NFC to find Revolut users nearby to send and receive payments — useful if friends and family also have Revolut accounts.

The Cards tab allows you to create virtual cards and control the security settings of your physical card. You can freeze and unfreeze it, view and unblock your PIN, set a monthly spending limit, and block or unblock online payments, swipe transactions, contactless payments and cash withdrawals. Security setting prevent phones from taking a screenshot of the tab.

The Dashboard tab is where you access all the account features from dropdown lists, including the Vaults, Perks, currency conversion, stock trading account, insurance, concierge, and so on. You can reorder them to keep your most used features at the top of the list.

The analytics tools are great for tracking spending and the instant notifications tell you how much you spent in your local and home currencies. The notifications are a good security tool, because you would know instantly if your card was used fraudulently.

You can fund your account by bank transfer, debit card, Apple Pay, Google Pay or by receiving payments. Bank transfers are credited with a notification instantly, while card transfers take longer.

Opening a Revolut account is pretty straightforward. Download the app and fill in your information. You’ll need to scan a photo ID to verify your identity and there are initial limitations to how much money you can transfer. This all went smoothly for me but I’ve seen online that other users have had problems with their accounts being locked, so start with small transfers to be on the safe side.

Trading

The advantage of using an app-based account is being able to trade on the go — think long journeys on planes or buses with wifi, cafes, or even the beach. I’ve got an investment ISA with my High Street bank that can only be accessed through a browser with a few steps of authentication and click-throughs to get through to the trading screens, making it an involved process that doesn’t work well on the run.

Setting up the Revolut trading account requires going through a few steps inputting your information and affirming you understand what you’re getting yourself into. You’ll need your National Insurance number to confirm your tax status and that you’re a non-US resident.

Once the account is set up you need to fund it with US dollars. You can transfer money from your Revolut account in another currency and it will be exchanged into the equivalent dollars. You then have access to some basic trading features. There’s a full list of the stocks available (US only at the moment) and you can set up a watchlist. Tap on a company name and it will open a screen with a chart showing its recent performance. From there you can buy or sell shares and set up share price alerts. Premium and Metal account users can also see selected news items about the company from third-party sources.

On the main trading page you’ll see your shares listed by company showing the share price, the number of shares you own, the value of your shares and the gain or loss since you bought them. Below is your cash balance. A transactions tab lists all of your trading activity.

This is a basic account, so you can’t set up orders to buy or sell when shares reach a certain price, meaning you risk losing a lot of money or missing out on a trade. The share prices displayed are on a delay, so you should be aware that if it’s volatile your buy or sell transaction will likely be completed at a higher or lower price than what you can see. It may only be a dollar or two but it could make a difference with larger transactions. You are limited to 3 day trades (buying and selling the same company stock on the same day) in a 5 working day period.

Verdict

I’m really happy with Revolut as a low-cost account to use abroad. The commission-free foreign currency transactions and withdrawals are saving me money living abroad, and it’s nice to get a little cashback. The 1.35% savings rate is paying me multiple times the interest that my High Street bank is paying, and the automatic rounding up is a great way to save money without really noticing. The analytics tab and budgeting tools are useful way to actively manage your spending.

But, oh, the trading account. It’s making me miserable on a daily basis. I will be withdrawing the money from it and opening another app-based trading account elsewhere. I really wanted it to work but I have to break up with it.

I should’ve known when opening the trading account that it wouldn’t go well. During the process the app took several attempts to input information into certain fields, it froze, and it reloaded some screens more than once. In all it took more than an hour, when it should’ve taken minutes, but I got the account set up eventually. It turns out the trading section of the app is unstable.

It will randomly crash and reload the main screen in the middle of a trade, it will get stuck on a blank screen trying to load a stock page, it will sometimes not update when the stock market opens in the morning, so that more than half an hour into the trading day it will still show the market as closed and you will be unable to buy and sell stocks. It’s at its worst in the first hour of the trading day, from 9:30-10:30am US Eastern Time, which is when the market tends to be particularly volatile, so it seems that it can’t handle all the data. It’s really a shame because if it worked as it should it would be a good feature of the app.

Use Revolut for the Internet banking, steer clear of the trading.

Receive free delivery on a Standard account card with my referral link

Hi, I have a standard Revolut account and I’m really happy with it for now. I did try to use the trading feature and it’s a pain, it freezes as soon as the market opens. Hopefully, being a new feature, it will become more stable soon.

Thanks for sharing, I was ignoring the savings feature, I’ll look into it.

Anda